(Mlive) - The Internal Revenue Service (IRS) will be sending the first installment in a series of advance payments between $250 and $300 per month per eligible family starting on July 15.

Around 36 million eligible American families this summer will receive financial relief from the federal government as part of the 2021 Child Tax Credit.

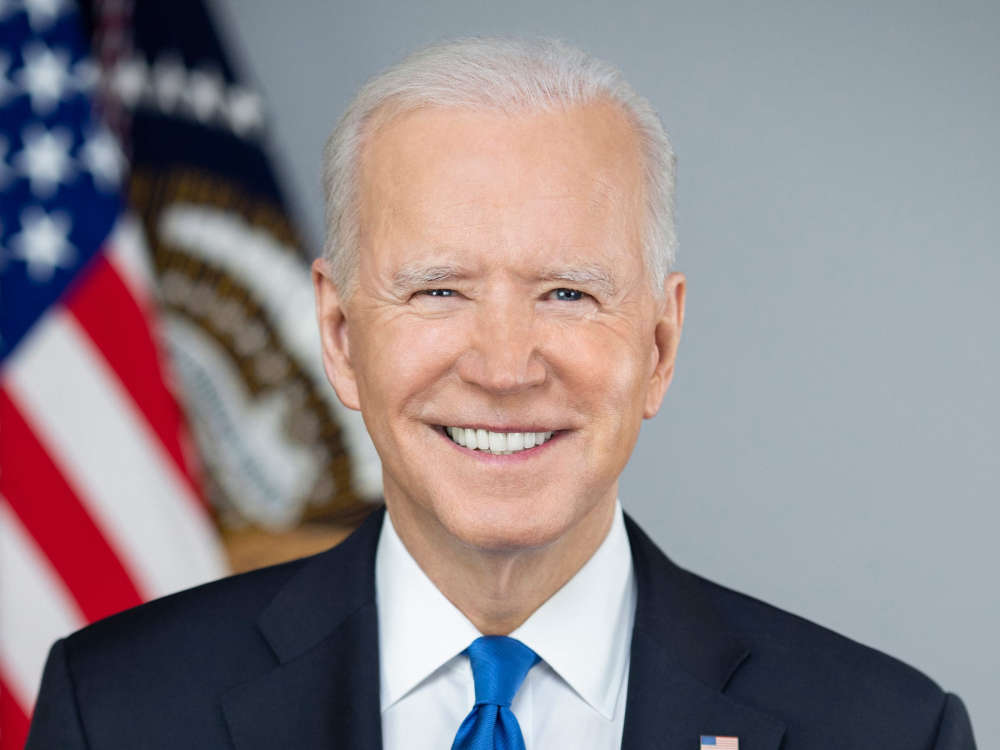

President Joe Biden signed the enhanced Child Tax Credit into law as part of the American Rescue Plan. Eligible families under the enhanced Child Tax Credit are expected to receive up to $1,800 in payments by the end of December.

The Biden administration’s effort expanded the child tax credit from a $2,000 benefit per year, taken when taxes are filed, to an up-to-$3,600-benefit per child.

The enhanced Child Tax Credit also gave eligible families an option to receive monthly advance cash payments from July to December 2021 and allowed the rest of the money to be claimed on a 2021 tax return.

Who is eligible for the 2021 Child Tax Credit?

These people can take advantage of the maximum child tax credit, according to the White House:

- An eligible family making up to $150,000 filing as a couple

- A parent filing as head of household making up to $112,500

- A single parent filing alone making up to $75,000

Those who can take advantage of the maximum amount of the child tax credit will receive up to $300 per child under 6 years old and up to $250 per child between the ages of 6 and 17 in monthly installments through the end of 2021.

This group of people will also be able to take advantage of the other half of the money when they file their 2021 tax return.

In total, these families are eligible to receive up to $3,000 per year for children between 6 and 17 years old, and up to $3,600 per year for children under the age of 6.

To qualify, the child needs a Social Security number and must have lived with the taxpayer for at least six months during the year.

Parents with dependents between the ages of 18 and 24 years old can also claim child tax credit money, but they will have to wait until they file their taxes in 2022 to receive the money.

How do you claim the child tax credit?

If an eligible family making up to $150,000 if filing as a couple or a single parent filing as head of household making up to $112,500 has children, these families will be eligible to take advantage of the child tax credit, according to the White House.

Most families who have filed a tax return in 2019 and 2020 or signed up to receive a stimulus check do not need to do anything and will receive their benefits automatically.

For those families that do not fall under either of those categories, the IRS has a “nonfilers tool” where a person is asked some basic personal information to determine eligibility.

What if I make more than the income thresholds?

Families will still able to receive some money if they make above the income thresholds for the enhanced Child Tax Credit.

But there is a limit. For every $1,000 a family makes over an income threshold, they receive $50 less in payments.

How do I opt out?

There may be good reasons for some taxpayers to opt out and refuse to take the monthly advance payments, experts previously told NJ.com.

The IRS said people can “opt out” using a tool called the Child Tax Credit Update Portal that is currently live on the IRS.gov website.

This tool will allow people to waive the tax credit before the first payment is due on July 15.

7/31/23 - Gas Prices Spike As Heat Wave Continues

7/31/23 - Gas Prices Spike As Heat Wave Continues

7/31/23 - MSC Strikes Down Changes to Car Insurance Law

7/31/23 - MSC Strikes Down Changes to Car Insurance Law

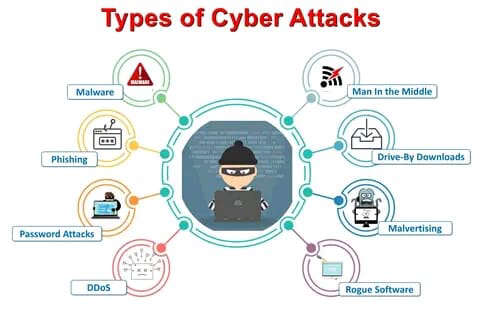

6/16/23 - Cybersecurity Issues Plague an Estimated 6 Million Americans

6/16/23 - Cybersecurity Issues Plague an Estimated 6 Million Americans

4/10/23 - 10k Grants Help Women Entrepreneurs in Michigan

4/10/23 - 10k Grants Help Women Entrepreneurs in Michigan